This month, I’m calling BS on some of the biggest myths in the bookkeeping biz.

Finance and accounting are SUCH male-dominated spaces, and I think sometimes that can leave the rest of us feeling a little unsure or uneasy.

If you don’t agree with the “experts,” does that make you dumb? Naive? Just plain wrong?

NOOOOOOOO!

In fact, I urge you to question everything. Think critically. And do what works for you.

Why?

Because under that ultra-confident exterior, these “experts” are often:

- Pushing systems that work for them, but may not be right for everyone.

- Almost always guilty of justifying their reasoning (or worse mansplaining – ughhh).

- Frankly? They tend not to be that qualified to be giving advice in the first place (I am looking at you dude – the one with a smidge of real world experience).

So the first myth I’m busting?

Myth #1: “You should niche down.”

Let’s get into it.

First, a Quick Disclaimer

I knoooow, I might sound a little contradictory giving advice while telling you not to listen to advice. But here’s the thing: you will never hear me say “Do x,y, and z or you will fail.”

No ma’am. I’m here to share what I know, give you the tools and tips that helped me scale, and cheer you on every step of the way (even if your way is different from mine).

Okay? Okay. Back to it.

The value of finding your niche

Every type of business has its own nuances or industry-specific quirks, so specializing in a few areas can actually make you much more desirable. When companies start searching for bookkeepers, having that background knowledge creates a strong selling point during your sales calls.

Think about it: Most bookkeepers can manage the basics, but having the ability to address a potential client’s unique needs is a HUGE differentiator.

All of this to say, yes, it’s good to find your niche.

Buuuut….

Diversifying: A costly lesson from Covid

You can also trap yourself into a corner by going TOO niche.

Think of the stock market. Any financial professional will tell you “Don’t put all your eggs in one basket.” Why? Because investing in one business, or even one sector, is a big gamble—and proven time and time again not to be worth the risk. Diversifying is the name of the game.

Here’s a prime example of how you can niche yourself into a jam.

When 2020 came, some industries were hit much harder than others. Imagine if your bookkeeping biz only worked with clients in hospitality, travel, or food service. The majority (if not all) of your revenue would have been slashed practically overnight. Because unfortunately, when times get tough, outsourced services like bookkeeping are often the first to go.

Let’s go back in time even further to the 2008 financial crisis. I was still fairly new (and yeah, a little naive), and I relied on one client for about 40% of my revenue. When the economy took a nosedive, he jumped ship. It was like the rug was pulled out from under me. In one day I lost 40% of my business. Not to mention… it was my birthday. 😫🎂

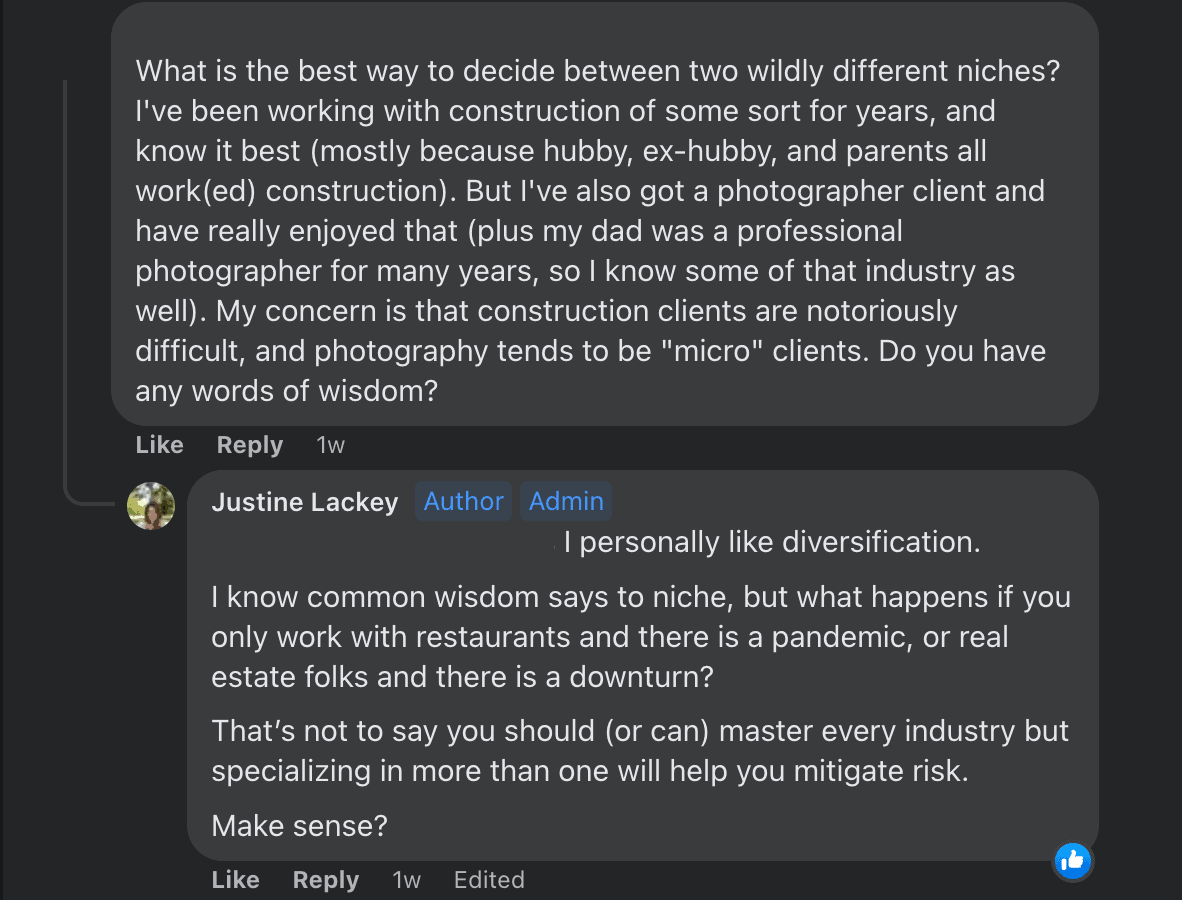

Soooo the lesson here? Finding a niche is great, but consider diversifying. Here’s a perfect example from a convo that recently came up in the free Facebook group 👇

How to pick a niche

Now for the question you’re most curious about:

“Justine, how do I pick a niche, without boxing myself in?”

Here’s my advice. Start by asking yourself… What type of businesses am I comfortable working with? And what type of businesses am I not comfortable working with?

Chances are, you have more than one area of interest or experience. And taking the time to decide who you don’t want to work with is helpful too.

For example, at Good Cents we don’t generally work with retail, manufacturing, or construction companies. But we LOVE working with digital product entrepreneurs, and branding, pr, graphic and creative companies.

BTW – A good way to determine your niche is to develop an ideal client avatar (ICA). I talked more on this in a previous blog post, I recommend giving it a read if you’re still in the process of defining your target market.

Consider Complimentary Industries

I should mention you might find it helpful to work in complementary industries.

For example, you might start out working with photographers, but find a natural progression to working with stylists or branding + PR agencies.

This creates more opportunity for bringing on new clients while still staying in your “comfort zone.”

Conclusion

Woohoo, consider myth #1 officially busted. 💥

In my next post, I’m taking on a long-standing industry hot topic: pricing models.

Always rooting for you,

Justine

P.S. Are you getting my emails? Every Wednesday, I send along more thoughts, tips, and tricks designed specifically for bookkeepers like you. Learn more about landing high paying clients, scaling your business, and transitioning from freelancer to founder. So, what are you waiting for? Go ahead, subscribe away!